In our July outlook, we noted that many emerging markets have improved their balance sheets, which we believe may make them less vulnerable to an eventual rise in U.S. short-term interest rates. Below, Portfolio Specialist Todd Speed presents some analysis that supports this view.

--Nick Niziolek, CFA, Senior Co-Portfolio Manager and Head of International Research

Todd Speed, CFA, Portfolio Specialist

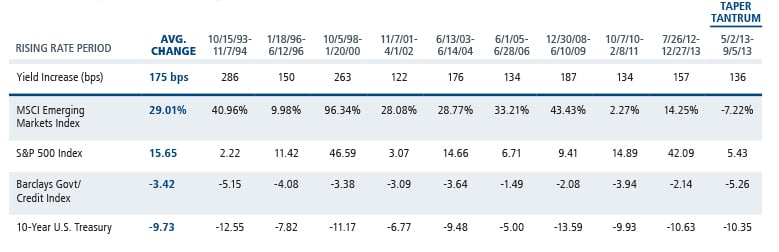

Many investors are worried about the impact rising U.S. interest rates and a stronger dollar will have on emerging markets, as a rate hike may constrain the availability of credit and further strengthen the dollar. Fueling the fire, recent market headlines that EMs will suffer when the Fed hikes rates and the spillover effect the “taper tantrum” of 2013 created are understandably causes for concern. However, we believe EMs are generally less fragile and better positioned ahead of future rate hikes. Compared to just a few years ago, many EMs have reduced their deficits, and by extension their vulnerability to foreign capital flows, and EM currencies have depreciated versus the dollar. Moreover, in the past 25 years when the 10-year Treasury yield rose more than 100 basis points, EMs have generally outperformed the S&P 500 Index and delivered strong absolute gains. The “taper tantrum” may be more of an outlier than a prediction of things to come.

EMs Have Been More Resilient to Rising Rates Past performance is no guarantee of future results. Current performance may be lower or higher than the performance quoted. Indexes are unmanaged, do not reflect fees or expenses and are not available for direct investment. Rising rate environment periods are from troughs to peak from October 1993 to December 2013. Source: Morningstar and Bloomberg.

Past performance is no guarantee of future results. Current performance may be lower or higher than the performance quoted. Indexes are unmanaged, do not reflect fees or expenses and are not available for direct investment. Rising rate environment periods are from troughs to peak from October 1993 to December 2013. Source: Morningstar and Bloomberg.