Introducing Calamos Short-Term Bond Fund: Seeking Current Income and Lower Volatility

September 19, 2018

Today we introduce Calamos Short-Term Bond Fund (CSTIX), for investors seeking current income accompanied by lower volatility over a one-year to two-year time horizon.

Using a multi-sector fixed income strategy, the fund invests predominantly in U.S. issuers with the goal of generating a high level of current income with preservation of principal.

Key features include:

- We construct the portfolio bond-by-bond with a focus on being well compensated for risks taken.

- A broader investable universe enhances portfolio construction and risk management.

- We conduct robust, independent credit research.

- We assess how ESG factors impact a company’s cash flow and risk profile, making CSTIX one of just four funds in its Morningstar category that screens for Environmental, Social and Governance (ESG).

- We apply a macro overlay to capitalize on misunderstood industries and sectors.

"In today’s market environment, it is possible to attain yield close to that of the 30-year Treasury while taking on limited interest rate risk," says Matt Freund, Co-CIO, Head of Fixed Income Strategies, Senior Co-Portfolio Manager. "The shape of the yield curve has created the best opportunity to achieve this goal since 2008.”

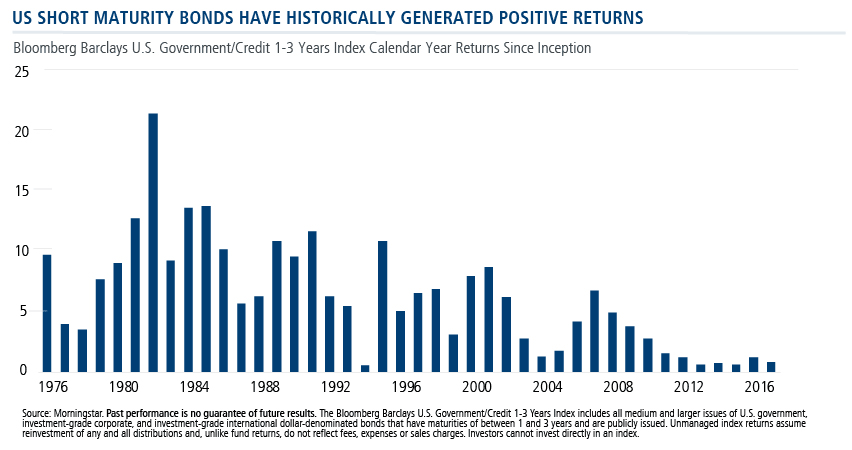

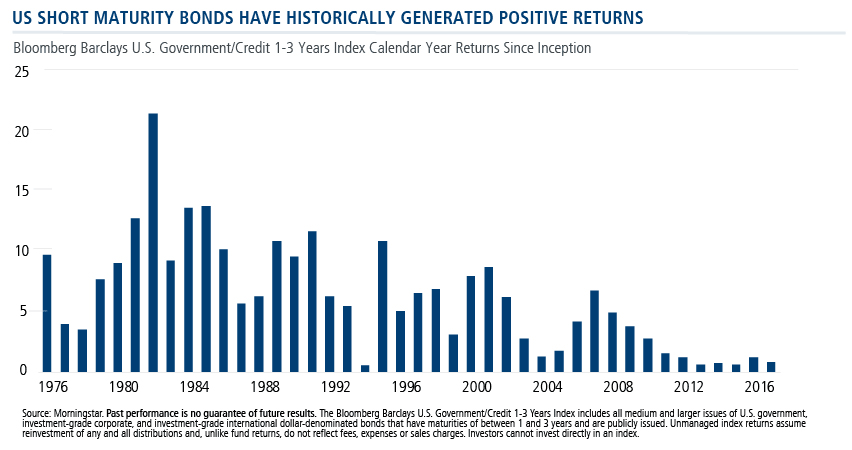

As shown in the graph below, adds Christian Brobst, Vice President and Associate Portfolio Manager, “Over a number of economic cycles and various conditions, from the Cold War era to the tech bubble and through the Great Financial Crisis, the benchmark (Bloomberg Barclays U.S. Government/Credit 1-3 Years Index) has experienced positive returns in each calendar year since its inception.”

Financial advisors, for more information about CSTIX or the Calamos Fixed Income Credit Analysis Process, talk to a Calamos Investment Consultant at 888-571-2567 or email caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Portfolios are managed according to their respective strategies which may differ significantly in terms of security holdings, industry weightings, and asset allocation from those of the benchmark(s). Portfolio performance, characteristics and volatility may differ from the benchmark(s) shown.

Environmental, Social and Governance (ESG) is based on the premise of investing in companies that have good environmental records, are ethically run and have a positive social impact.

Bloomberg Barclays U.S. Government/Credit 1-3 Years Index includes all medium and larger issues of U.S. government, investment-grade corporate, and investment-grade international dollar-denominated bonds that have maturities of between 1 and 3 years and are publicly issued. Unmanaged index returns assume reinvestment of any and all distributions and, unlike fund returns, do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index.

The Bloomberg Barclays U.S. Government/Credit 1-3 Years is not intended to act as a proxy for the Calamos Short-Term Bond Fund.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Short-Term Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower to miss payments, high yield risk, liquidity risk, mortgage-related and other asset-back securities risk, including extension risk and prepayment risk, U.S. Government security risk, foreign securities risk, non-U.S. Government obligation risk and portfolio selection risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

801302 0919

Exp. 09/2019