Our team continues to have discussions with financial advisors regarding strategies for keeping drawdowns from prematurely depleting retirement portfolios and threatening retirement plans. We wrote about the topic in a post last month (see

Decumulation and Volatility: Advisors’ Focus as Clients Approach Retirement) and have since been asked to be more specific.

As a quick recap: Our April post suggested introducing an equity long/short strategy to a traditional 60/40 distribution portfolio. We showed the results of hypothetical illustrations of two scenarios:

- 30% long/short equity (using the HFRI Equity Hedge Index as a proxy), 30% long equity (Standard & Poor’s 500) and 40% fixed income (Bloomberg Barclays U.S. Aggregate Bond Index)

- 60% long/short equity (using the HFRI Equity Hedge Index as a proxy) and 40% fixed income (Bloomberg Barclays U.S. Aggregate Bond Index)

Reducing the volatility, including drawdowns, had a significant impact during the withdrawal phase. The result was stronger risk-adjusted returns.

Funding a Decumulation Plan

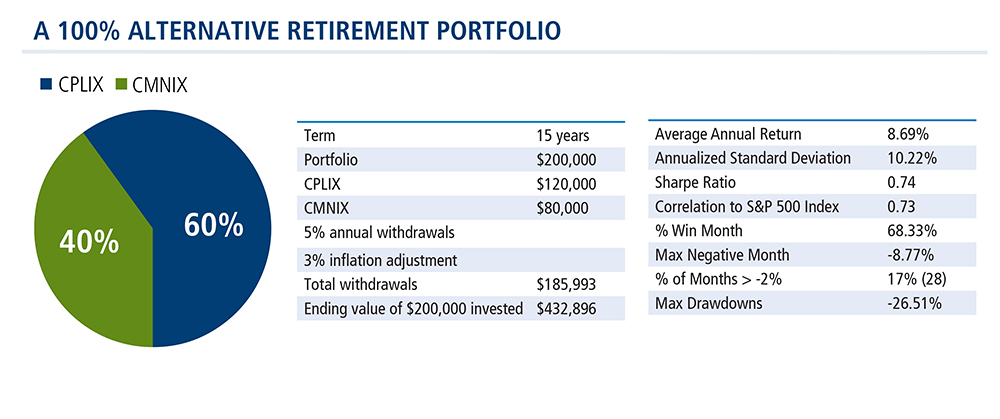

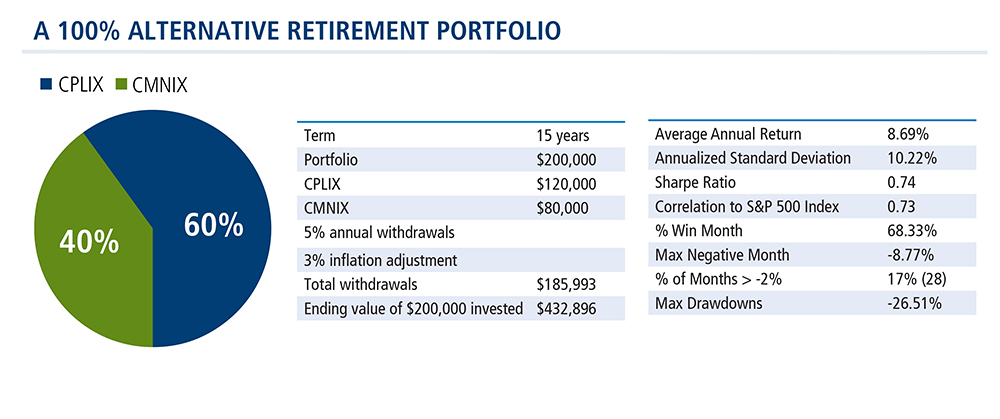

Here’s how the idea works using a hypothetical 100% alternative portfolio.

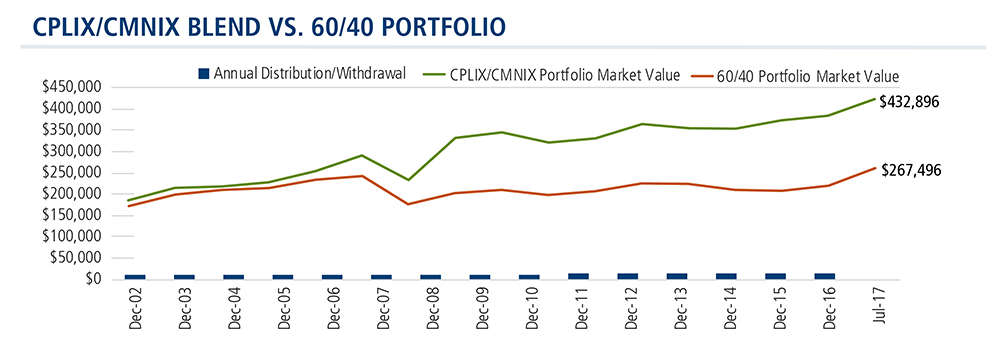

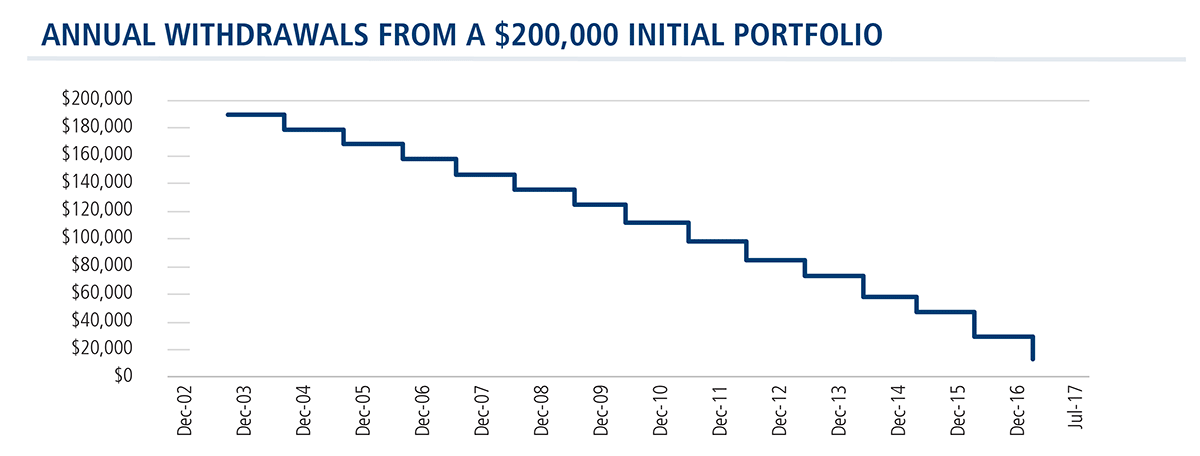

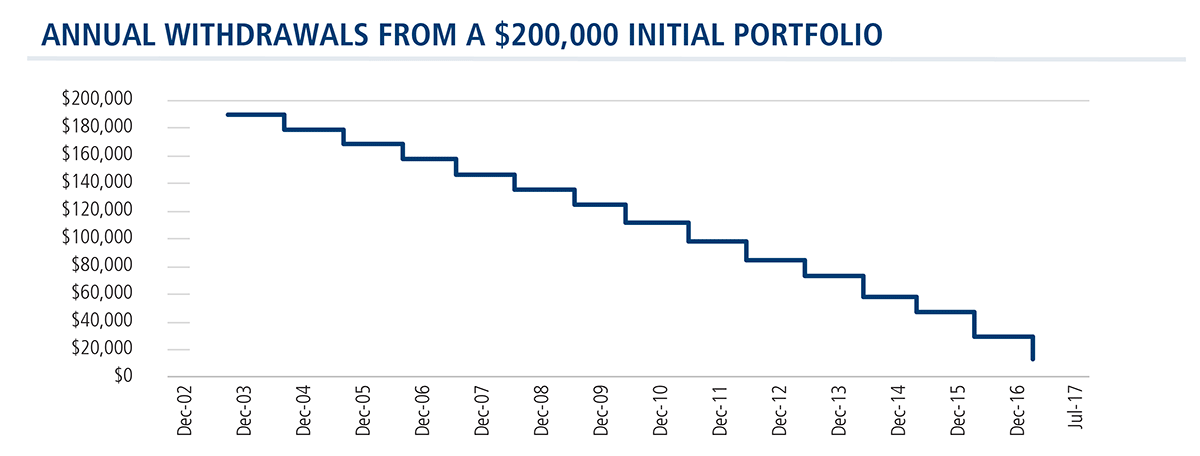

We start in May 2002 with a $200,000 portfolio and plan to withdraw 5% per year, with a 3% adjustment for inflation. Distributions are taken in December 2002, and in December of subsequent years. In year 1, the annual withdrawal is $10,000, which grows to $15,126 by year 15.

So this is the advisor’s challenge: How to fund a decumulation plan totaling $185,993 from a $200,000 initial investment, as illustrated below.

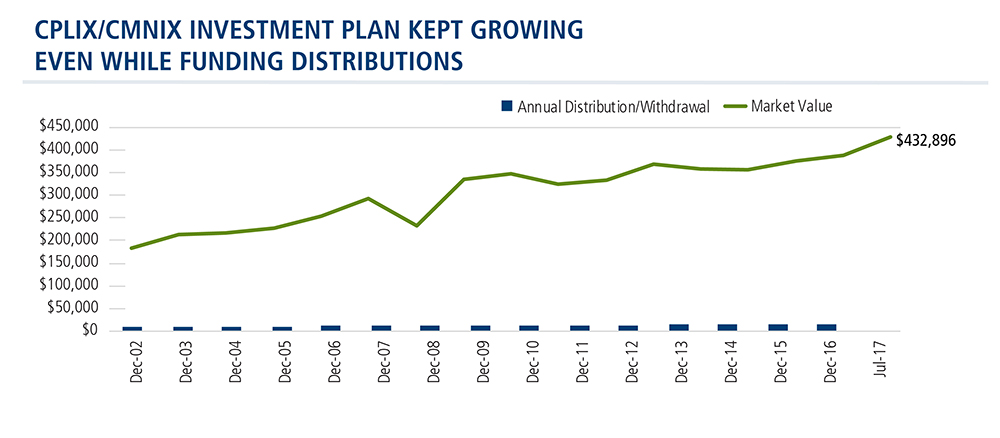

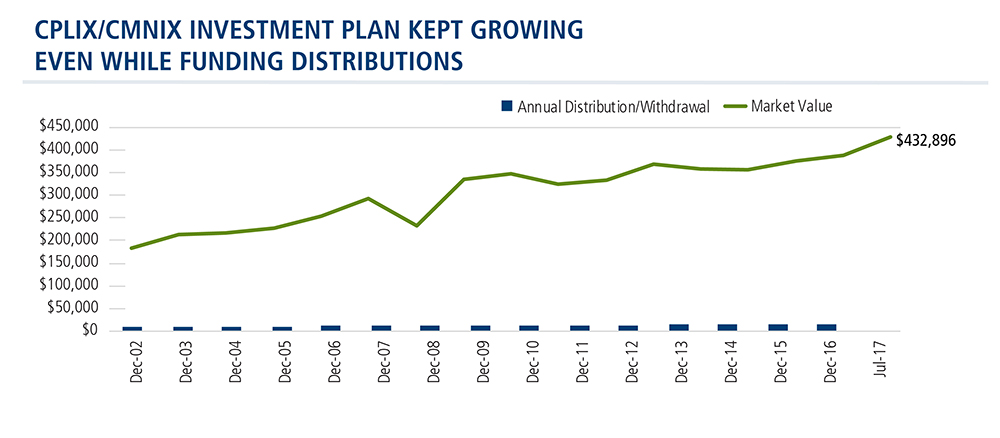

Here’s what happened in a hypothetical illustration that combined a 60% allocation of our equity alternative Calamos Phineus Long/Short Fund (CPLIX) and a 40% allocation of our fixed income alternative Calamos Market Neutral Income Fund (CMNIX). A $200,000 portfolio provided for $185,993 in total withdrawals, and $392,651—almost twice as much as the original investment—remained at the end of the 15-year period.

Here’s what happened in a hypothetical illustration that combined a 60% allocation of our equity alternative Calamos Phineus Long/Short Fund (CPLIX) and a 40% allocation of our fixed income alternative Calamos Market Neutral Income Fund (CMNIX). A $200,000 portfolio provided for $185,993 in total withdrawals, and $392,651—almost twice as much as the original investment—remained at the end of the 15-year period.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. For the most recent month-end fund performance information visit www.calamos.com.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. For the most recent month-end fund performance information visit www.calamos.com.

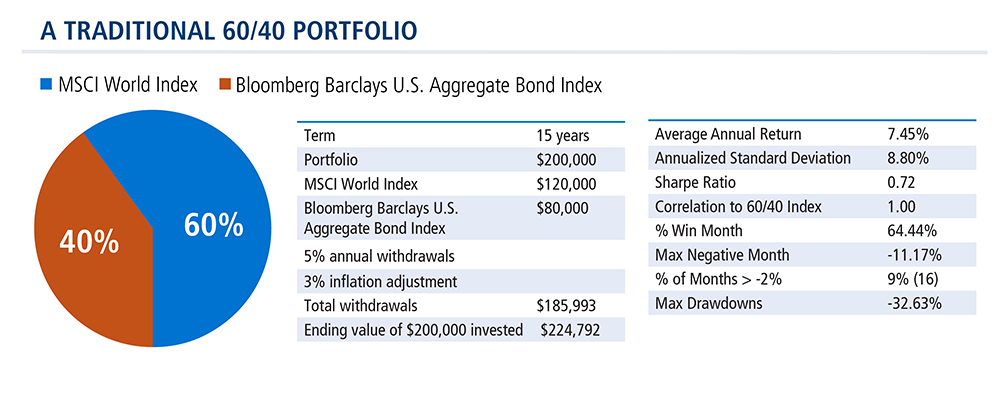

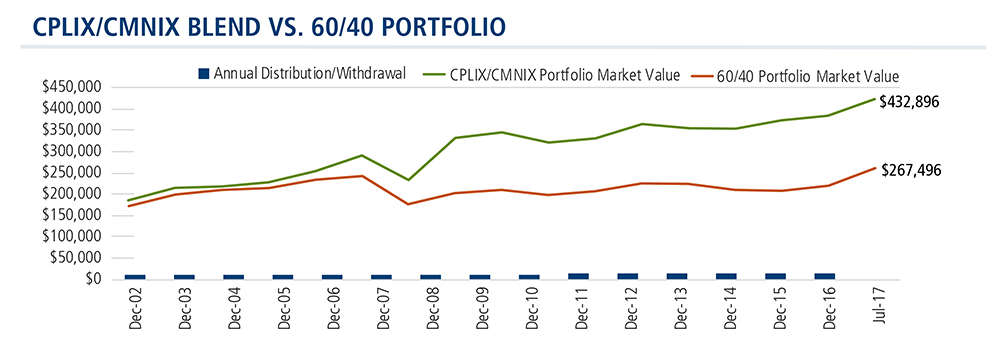

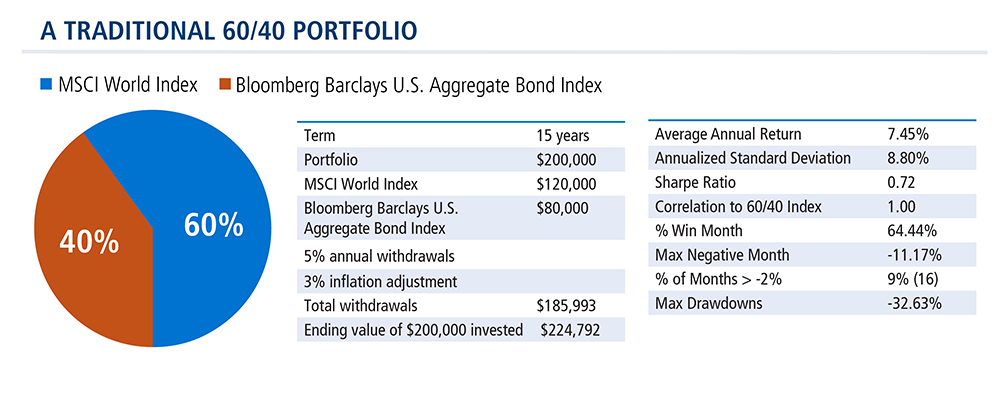

Let’s compare these results to a more traditional portfolio with a 60% MSCI World Index equity allocation and a 40% Bloomberg Barclays U.S. Aggregate Bond Index fixed income allocation.

The traditional portfolio funded the decumulation plan, but the alternative portfolio finished the distribution period with an almost 75% higher return.

The traditional portfolio funded the decumulation plan, but the alternative portfolio finished the distribution period with an almost 75% higher return.

A few words about volatility measures: Note that the standard deviation of the alternative blend is higher than the standard deviation of the traditional portfolio. One of the “flaws” of standard deviation is that it measures downside and upside volatility—potentially penalizing good volatility (gains).

Also consider the Sharpe ratio and Sortino ratios when evaluating CPLIX, in particular. The Sharpe ratio measures the excess return per unit of risk. A comparison of the Sharpe ratio of the alternative blend to the blended index reveals greater returns per unit of risk. This suggests better managed volatility.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. For the most recent month-end fund performance information visit www.calamos.com.

For Clients in the Accumulation Stage

Volatility is important to manage for your retired clients. But CPLIX and CMNIX also can be combined for an effective alternative allocation as part of an accumulation portfolio producing better investment returns (see our Jumpy Markets? This ‘Half Caff’ Blend Cuts Back on the Volatility While Pursuing Better Returns post). Advisors, for more information on this analysis, talk to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

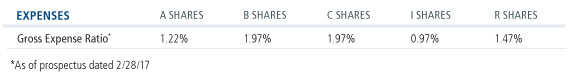

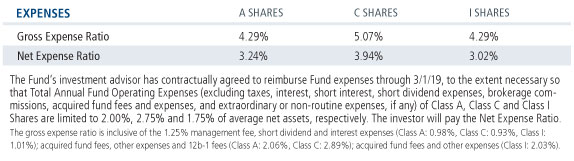

Calamos Phineus Long/Short Fund

The performance shown for periods prior to 4/5/16 is the performance of a predecessor investment vehicle (the “Predecessor Fund”). The Predecessor Fund was reorganized into the Fund on 4/5/16, the date upon which the Fund commenced operations. On 10/1/15 the parent company of Calamos Advisors, purchased Phineus Partners LP, the prior investment adviser to the Predecessor Fund (“Phineus”), and Calamos Advisors served as the Predecessor Fund’s investment adviser between 10/1/15 until it was reorganized into the Fund. Phineus and Calamos Advisors managed the Predecessor Fund using investment policies, objectives, guidelines and restrictions that were in all material respects equivalent to those of the Fund. Phineus and Calamos Advisors managed the Predecessor Fund in this manner either directly or indirectly by investing all of the Predecessor Fund’s assets in a master fund structure. The Predecessor Fund performance information has been adjusted to reflect Class A and I shares expenses. However, the Predecessor Fund was not a registered mutual fund and thus was not subject to the same investment and tax restrictions as the Fund. If it had been, the Predecessor Fund’s performance may have been lower. For the most recent month-end fund performance information visit www.calamos.com.

*Prior to 2/28/17, the Fund had a maximum front-end sales load of 4.75%.

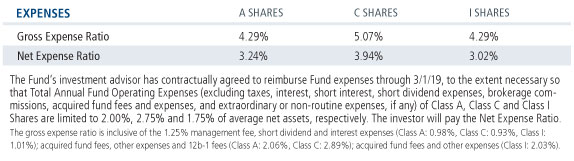

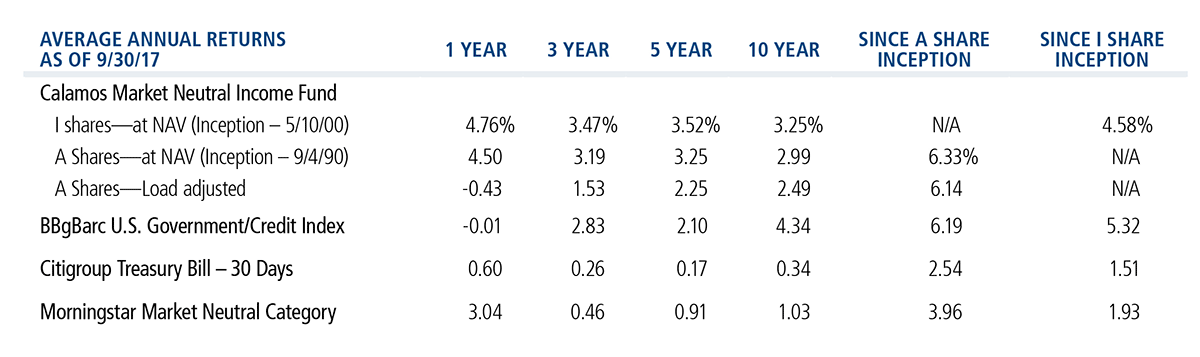

Calamos Market Neutral Income Fund

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

The performance shown in this post is hypothetical in nature and does not represent the performance and/or investment risk characteristics of any specific client. While the performance listed for each respective investment is based on actual performance, the aggregate portfolio performance, allocations listed and account comparisons shown are hypothetical in nature, as no actual clients are invested in these blended strategies. Hypothetical performance results have many inherent limitations, including those described below:

- Hypothetical performance results are generally prepared with the benefit of hindsight.

- There are limitations inherent in model results, such results do not represent actual trading and that they may not reflect the impact that material economic and market factors might have had on the advisor's decision making if the advisor were actually managing clients' money. In the hypothetical accounts shown actual 3rd party advisor performance has been blended in various allocations.

- The hypothetical performance shown does not involve financial risk, and no hypothetical performance calculation can completely account for the impact of financial risk on an actual investment strategy.

- The ability to withstand actual losses or to adhere to a particular investment strategy in spite of losses are material points which can adversely affect actual performance results.

There are distinct differences between hypothetical performance results and the actual results subsequently achieved by a particular investment portfolio. No representation is being made that an account will or is likely to achieve profits or losses similar to those shown, and any investment may result in loss of principal.

As with any hypothetical illustration there can be additional unforeseen factors that cannot be accounted for within the illustrations included herein.

Hypothetical performance and index returns presented assume reinvestment of any and all earnings/distributions.

Some of the risks associated with investing in alternatives may include hedging risk–hedging activities can reduce investment performance through added costs; derivative risk–derivatives may experience greater price volatility than the underlying securities; short sale risk - investments may incur a loss without limit as a result of a short sale if the market value of the security increases; interest rate risk–loss of value for income securities as interest rates rise; credit risk–risk of the borrower to miss payments; liquidity risk–low trading volume may lead to increased volatility in certain securities; non-U.S. government obligation risk–non-U.S. government obligations may be subject to increased credit risk; portfolio selection risk – investment managers may select securities that fare worse than the overall market. Alternative investments may not be suitable for all investors.

Class I shares are offered primarily for direct investment by investors through certain tax-exempt retirement plans (including 401(k) plans, 457 plans, employer-sponsored 403(b) plans, profit sharing and money purchase pension plans, defined benefit plans and non-qualified deferred compensation plans) and by institutional clients, provided such plans or clients have assets of at least $1 million. Class I shares may also be offered to certain other entities or programs, including, but not limited to, investment companies, under certain circumstances.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

Covered call writing: As the writer of a covered call option on a security, the fund foregoes, during the option’s life, the opportunity to profit from increases in the market value of the security, covering the call option above the sum of the premium and the exercise price of the call.

Convertible securities risk: The value of a convertible security is influenced by changes in interest rates, with investment value declining as interest rates increase and increasing as interest rates decline. The credit standing of the issuer and other factors also, may have an effect on the convertible security’s investment value.

Convertible hedging risk: If the market price of the underlying common stock increases above the conversion price on a convertible security, the price of the convertible security will increase. The fund’s increased liability on any outstanding short position would, in whole or in part, reduce this gain.

Convertible securities risk: The value of a convertible security is influenced by changes in interest rates, with investment value declining as interest rates increase and increasing as interest rates decline. The credit standing of the issuer and other factors also may have an effect on the convertible security’s investment value.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, options risk, and leverage risk.

Citigroup 30-Day T-Bill Index is generally considered representative of the performance of short-term money market instruments.

Bloomberg Barclays U.S. Government/Credit Index comprises long-term government and investment grade corporate debt securities and is generally considered representative of the performance of the broad U.S. bond market. Unlike convertible bonds, U.S. Treasury bills are backed by the full faith and credit of the U.S. government and offer a guarantee as to the timely repayment of principal and interest.

Morningstar Market Neutral Category represent funds that attempt to eliminate the risks of the market by holding 50% of assets in long positions in stocks and 50% of assets in short positions.

S&P 500 Index is generally considered representative of the U.S. stock market.

MSCI World Index is a market capitalization weighted index composed of companies representative of the market structure of 21 developed market countries in North America, Europe, and the Asia/Pacific region. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index.

Beta is a historic measure of a fund’s relative volatility, which is one of the measures of risk; a beta of 0.5 reflects 1/2 the market’s volatility as represented by the Fund’s primary benchmark, while a beta of 2.0 reflects twice the volatility.

Correlation is a statistical measure that shows how two securities move in relation to each other. A correlation of 1 implies that if one security moves up or down, the other security will move in lockstep, in the same direction. Alternatively, a correlation of 1 means that if one security moves in either direction, the other security will do the exact opposite.

Alpha is a historical measure of risk-adjusted performance. Alpha measures how much of a portfolio’s performance is attributable to investment-specific factors versus broad market trends. A positive alpha suggests that the performance of a portfolio was higher than expected given the level of risk in the portfolio. A negative alpha suggests that the performance was less than expected given the risk.

Maximum drawdown is an indicator of the risk of a portfolio chosen based on a certain strategy. It measures the largest single drop from peak to bottom in the value of a portfolio (before a new peak is achieved).

Sharpe ratio is a measure of risk-adjusted performance, where higher values are indicative of better investment decisions rather than the result of taking on a higher level of risk. Sharpe ratio is calculated by the difference between a portfolio’s return and a risk-free rate, often that of the 10-year Treasury bond, and dividing the result by the portfolio’s standard deviation.

Sortino ratio is the excess return over the risk-free rate divided by the downside semi-variance, and so it measures the return to "bad" volatility. (Volatility caused by negative returns is considered bad or undesirable by an investor, while volatility caused by positive returns is good or acceptable.)

Active management does not guarantee investment returns or eliminate the risk of loss.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

800177 0517

Here’s what happened in a hypothetical illustration that combined a 60% allocation of our equity alternative Calamos Phineus Long/Short Fund (CPLIX) and a 40% allocation of our fixed income alternative Calamos Market Neutral Income Fund (CMNIX). A $200,000 portfolio provided for $185,993 in total withdrawals, and $392,651—almost twice as much as the original investment—remained at the end of the 15-year period.

Here’s what happened in a hypothetical illustration that combined a 60% allocation of our equity alternative Calamos Phineus Long/Short Fund (CPLIX) and a 40% allocation of our fixed income alternative Calamos Market Neutral Income Fund (CMNIX). A $200,000 portfolio provided for $185,993 in total withdrawals, and $392,651—almost twice as much as the original investment—remained at the end of the 15-year period.

The traditional portfolio funded the decumulation plan, but the alternative portfolio finished the distribution period with an almost 75% higher return.

The traditional portfolio funded the decumulation plan, but the alternative portfolio finished the distribution period with an almost 75% higher return.