No Matter What: CMNIX

First published: May 22, 2017

Investment professionals have come to think of Calamos Market Neutral Income Fund (CMNIX) as their go-to fund. No matter what.

The fund is an alternative strategy that combines two principal strategies with different responses to volatility: convertible arbitrage seeks alpha and uncorrelated returns, while hedged equity provides income from options writing and upside participation. The fund also uses opportunistic strategies—SPAC arbitrage and merger arbitrage—that are used when conditions are favorable. Since 1990, CMNIX has been resiliently consistent and consistently resilient.

Resiliently Consistent

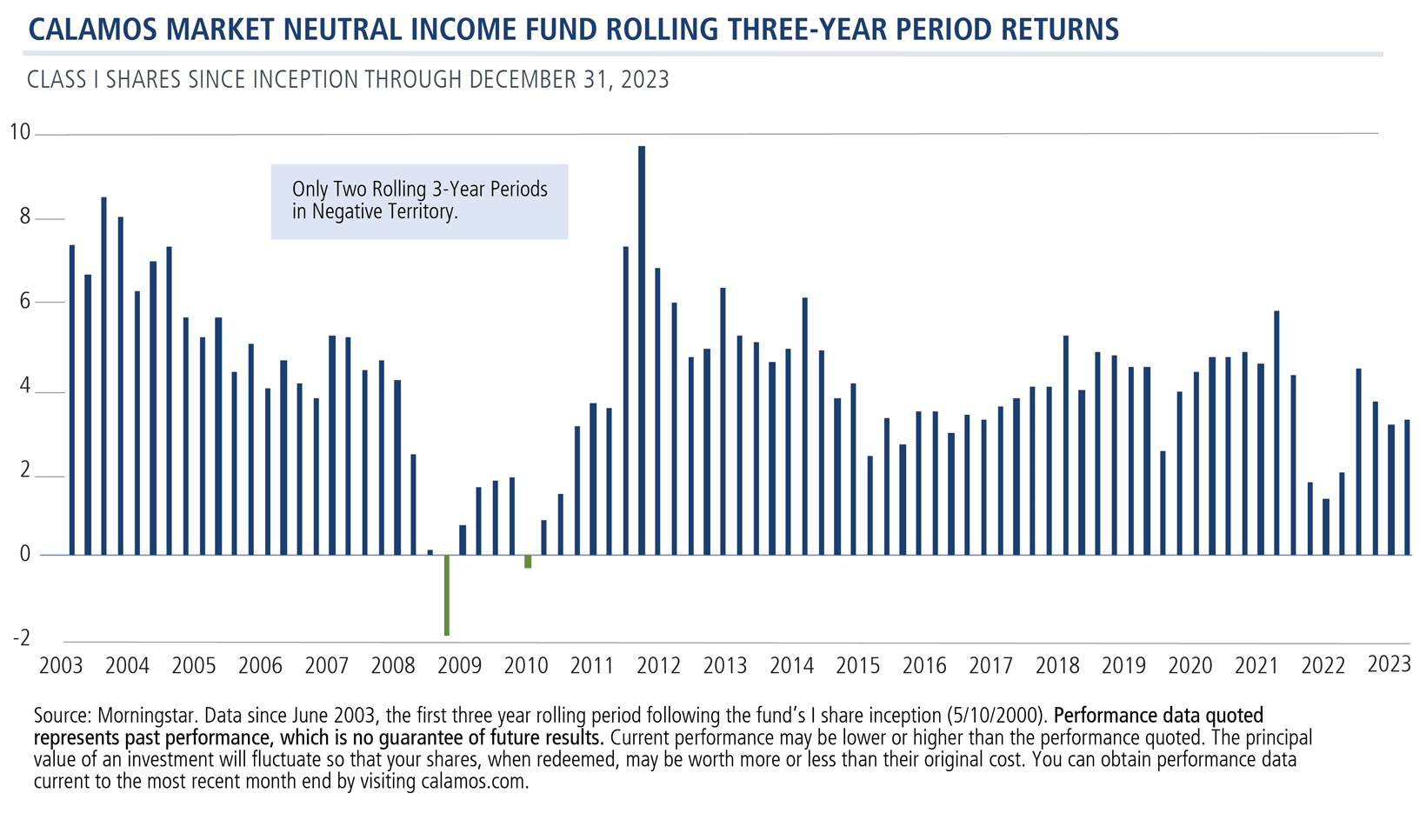

This view below shows the fund’s consistent positive returns, over rolling three-year periods since 2003. (I Shares were first available in 2000.)

Consistently Resilient

CMNIX’s consistency has occurred over multiple markets representing multiple—and in a few cases unprecedented—challenges.

What could go wrong that could get in the way of your clients achieving their investment objectives? Let’s consider three scenarios.

Scenario A: Rates could rise.

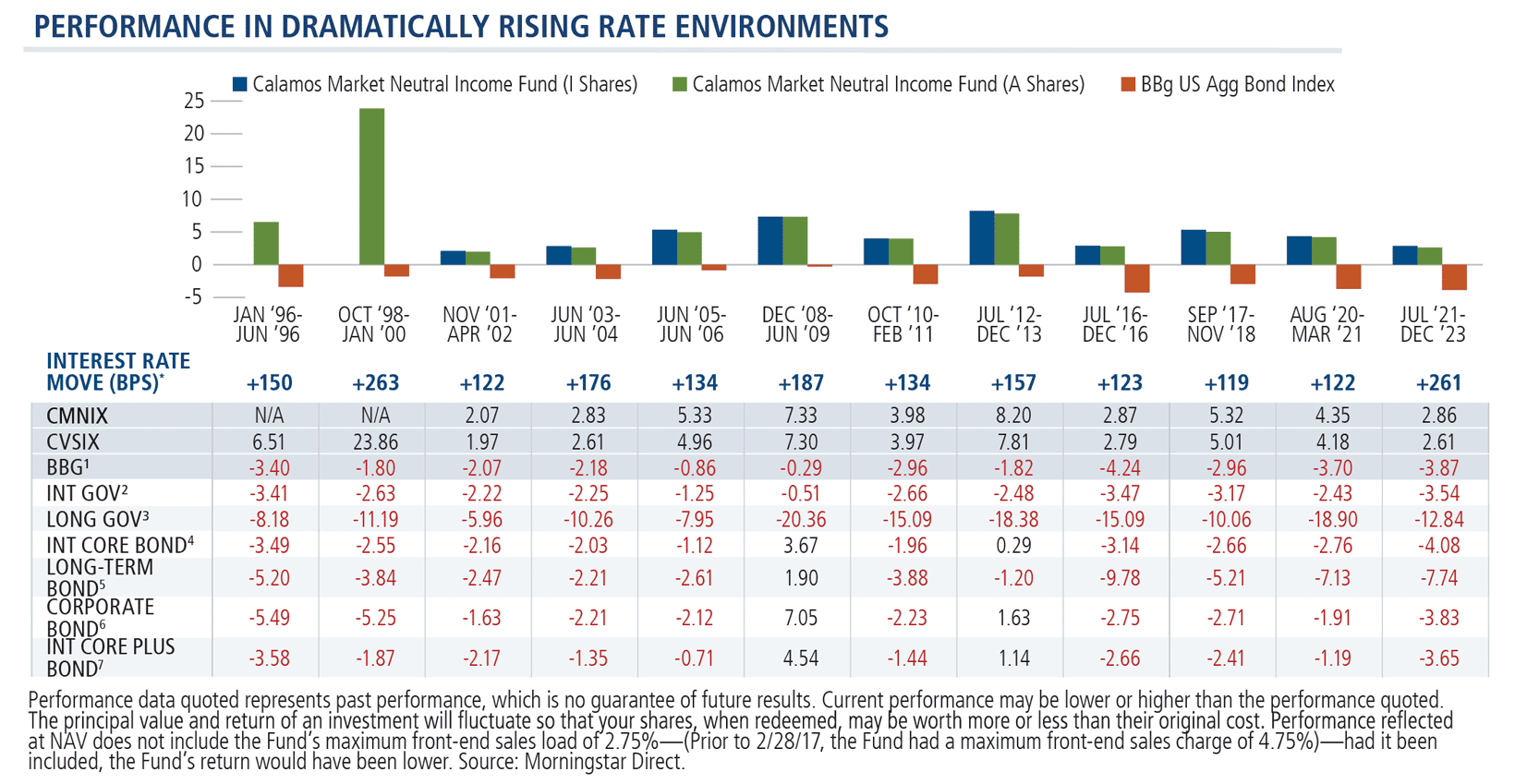

Rising interest rates challenge fixed income returns but not our income alternative. The fund’s core market strategies include hedged equity and convertible arbitrage. Together, these strategies are intended to provide the fund with an enhanced potential for risk-managed returns due to their differing responses to volatility.

Below we look at how the fund has outperformed against the Bloomberg US Aggregate Bond Index every time period—12 times since 1996—when interest rates rose more than 100 basis points.

Scenario B: Equity prices could fall.

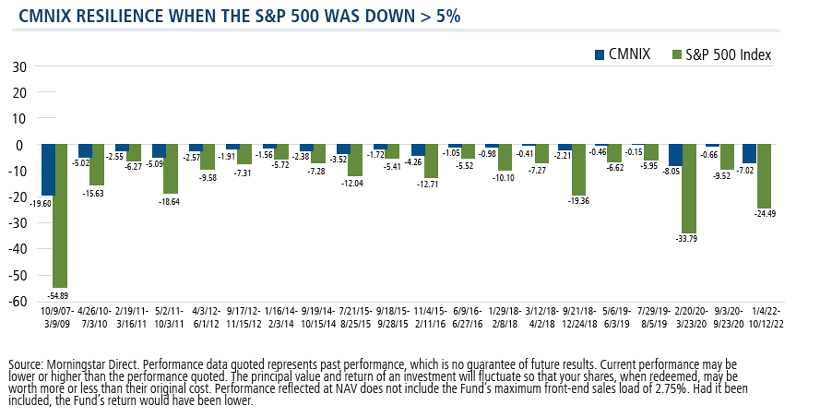

Of course, equity prices could fall, exposing portfolios to drawdowns. Here’s a look at CMNIX’s resilience over the last twenty periods when the S&P 500 was down 5% or more.

Scenario C: Volatility in the market could produce drawdowns.

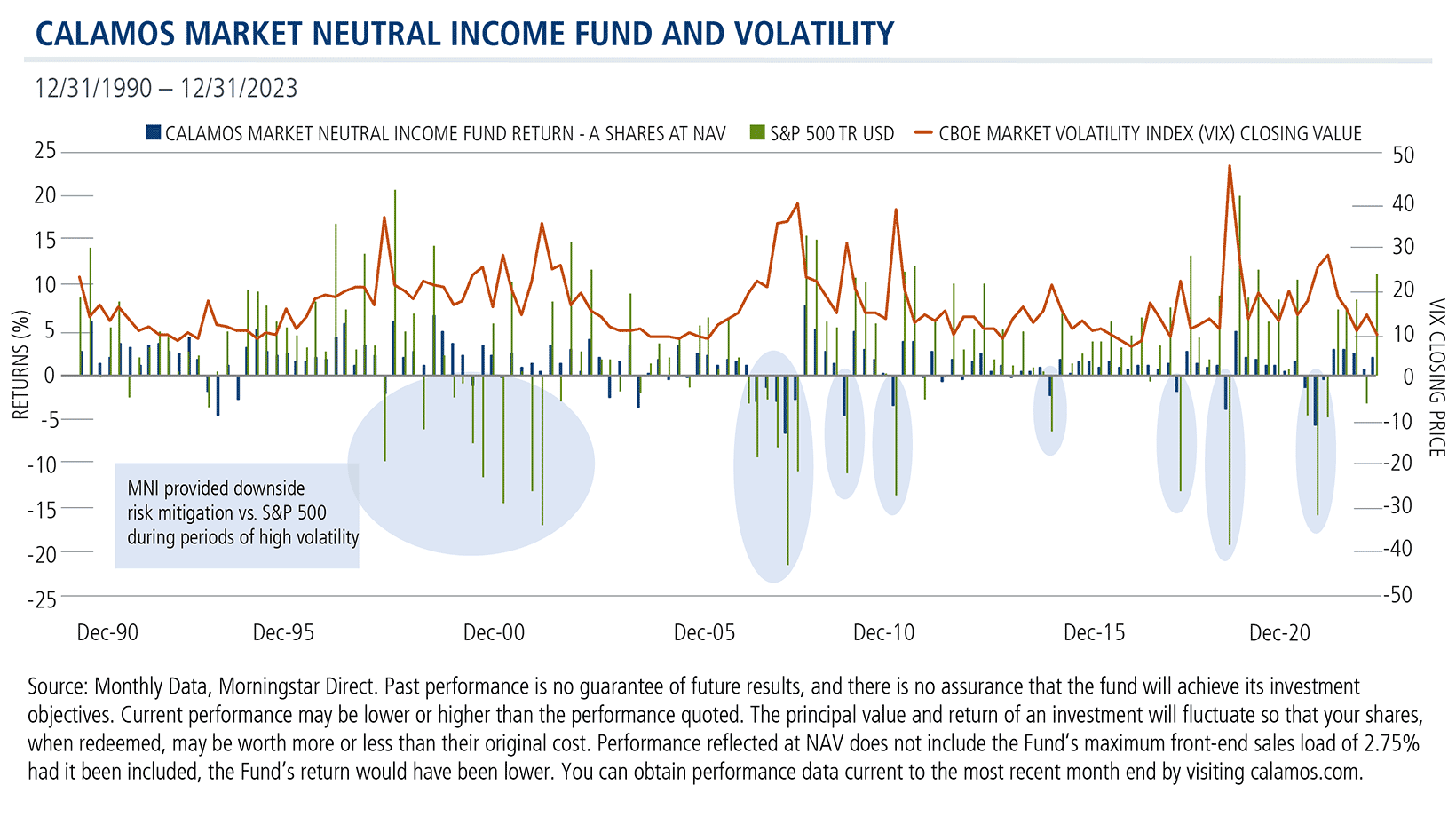

As illustrated by the chart below, compared to the S&P 500 Index, the fund has historically offered:

- Lower sensitivity to drawdowns during heightened volatility as a result of the fund’s hedged equity strategy. The strategy acts as a hedge to the S&P 500 through a combination of lower beta, income generated from dividends and option premiums, and gains in our put hedges.

- Smaller drawdowns, which were then followed by relatively strong performance as a result of the fund’s convertible arbitrage strategy. The strategy shorts the convertible bonds’ underlying stock.

So, that’s why we call CMNIX resiliently consistent and consistently resilient. For more ideas on the role it could play in the portfolios you're managing, contact your Calamos Investment Consultant at 866-363-9219 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

The principal risks of investing in the Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

Covered Call Writing: As the writer of a covered call option on a security, the fund foregoes, during the option’s life, the opportunity to profit from increases in the market value of the security, covering the call option above the sum of the premium and the exercise price of the call.

Convertible Securities Risk: The value of a convertible security is influenced by changes in interest rates, with investment value declining as interest rates increase and increasing as interest rates decline. The credit standing of the issuer and other factors also, may have an effect on the convertible security’s investment value.

Convertible Hedging Risk: If the market price of the underlying common stock increases above the conversion price on a convertible security, the price of the convertible security will increase. The fund’s increased liability on any outstanding short position would, in whole or in part, reduce this gain.

Convertible Securities Risk: The value of a convertible security is influenced by changes in interest rates, with investment value declining as interest rates increase and increasing as interest rates decline. The credit standing of the issuer and other factors also may have an effect on the convertible security’s investment value.

The VIX (CBOE volatility index) is the ticker symbol for the Chicago Board Options Exchange (CBOE) Volatility Index, which shows the market’s expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500 index options.

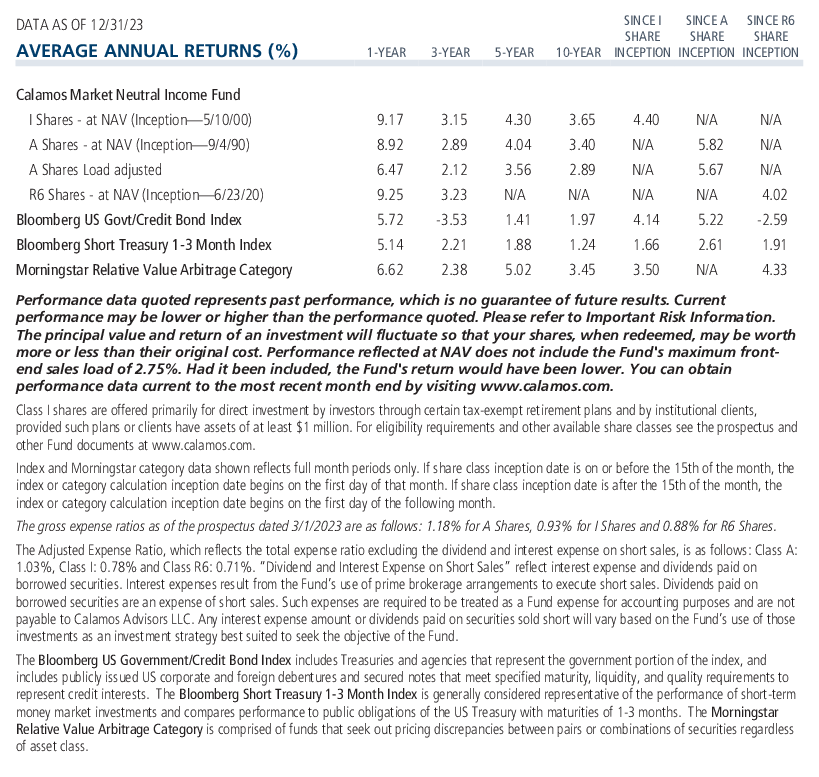

The Bloomberg Short Treasury 1-3 Month Index is generally considered representative of the performance of short-term money market investments and is provided to show how public obligations of the US Treasury with maturities of 1-3 months.

Bloomberg US Government/Credit Index comprises long-term government and investment grade corporate debt securities and is generally considered representative of the performance of the broad US bond market. Unlike convertible bonds, US Treasury bills are backed by the full faith and credit of the US government and offer a guarantee as to the timely repayment of principal and interest.

S&P 500 Index is generally considered representative of the US stock market.

Beta is a historic measure of a fund’s relative volatility, which is one of the measures of risk; a beta of 0.5 reflects 1/2 the market’s volatility as represented by the Fund’s primary benchmark, while a beta of 2.0 reflects twice the volatility.

800204 0124

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.