Whether you’re looking at recent history or long-term historical patterns, there’s no escaping the possibility that we may be heading into the most volatile time of the year.

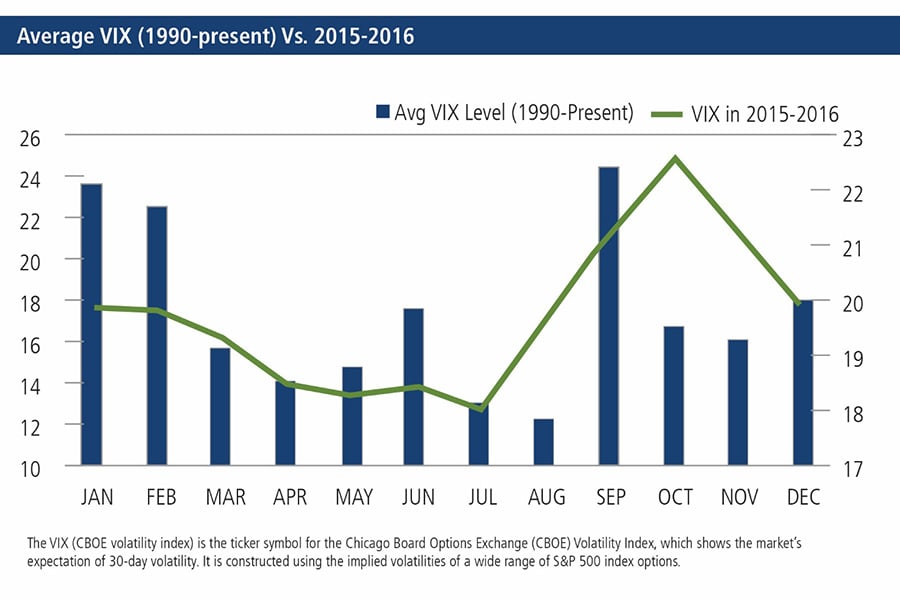

September has been the most volatile month for the stock market (Standard & Poor’s 500) over the last 26 years, as tracked by the CBOE Volatility Index (VIX). However, in 2015, high volatility in September foreshadowed even higher volatility in October. And, this year, uncertainty associated with the presidential election has the potential to shake markets further (see related post).

Short-term market swings pose a challenge to the individual investor, and even it’s been known to stymie even professional investors.

Short-term market swings pose a challenge to the individual investor, and even it’s been known to stymie even professional investors.

But managing volatility is Calamos’ specialty. Just in time for the likely pickup in volatility, we’ve updated our Volatility Opportunity Guide. Financial advisors, download the 44-page guide to read:

- Familiar and not-so-familiar analyses of the impact that volatility can have on markets and investments. Included is a comparison between how individual investors reacted to a surprise event and the market’s reaction to it (the June 2016 Brexit) versus how our money managers moved to benefit from the volatility.

- Our ideas on how lower-volatility strategies can simultaneously manage risk and pursue growth, while keeping your clients invested.

- And, peppered throughout, perspectives from Calamos associates—members of our portfolio management and distribution teams—on how volatility brings out the best in us.

Wait out the volatility? That’s not what we do, and this guide explains why.