A Seller’s Pain Can Be A Buyer’s Gain

Investors should never put themselves in the position of being a forced seller. Periods of volatility in markets are quite common and serve as strong reminders that investors must have a deep understanding of their liquidity needs.

Long-lasting bull markets often lead investors to a false sense of security. Frequently, these investors stretch and take positions outside their long-standing risk tolerance or, even worse, overreach on margin in an effort to maximize short-term gains. They then see these gains as permanent and any reduction to these (unrealized) gains as a loss. For most investors, losses hurt more than gains satisfy.

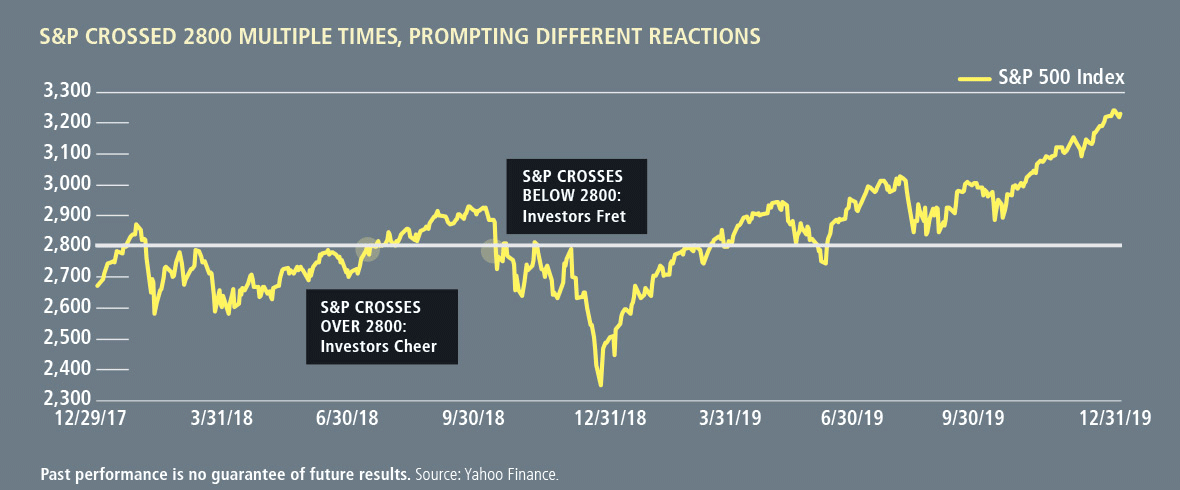

For example, let’s look at the S&P 500 Index through 2018. Investors celebrated reaching 2800 on the S&P in July and yet had the opposite response when those levels were retested in October.

Market volatility can lead to margin calls, regret over "losses" or anxiety over the risk profile of a portfolio—resulting in investors becoming forced sellers, and forced sellers are price-takers, typically at unattractive prices. That's unfortunate.

But there is an upside to market dynamics. For those investors who maintain healthy cash balances, manage leverage and take a long-term view, market volatility provides opportunities. This is especially true when the volatility is not related to changes in the underlying fundamentals of their investments. When an investment's fundamentals are unchanged but now available for purchase at a more attractive price that can be a positive. The seller's pain is the buyer's gain.

Return to the Volatility GuideOpinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Past performance is no guarantee of future results.

The Dow Jones Industrial Average is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry.

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Information contained herein is for informational purposes only and should not be considered investment advice.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

Matt Freund, CFA

Co-CIO, Head of Fixed Income Strategies, Senior Co-Portfolio Manager

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.