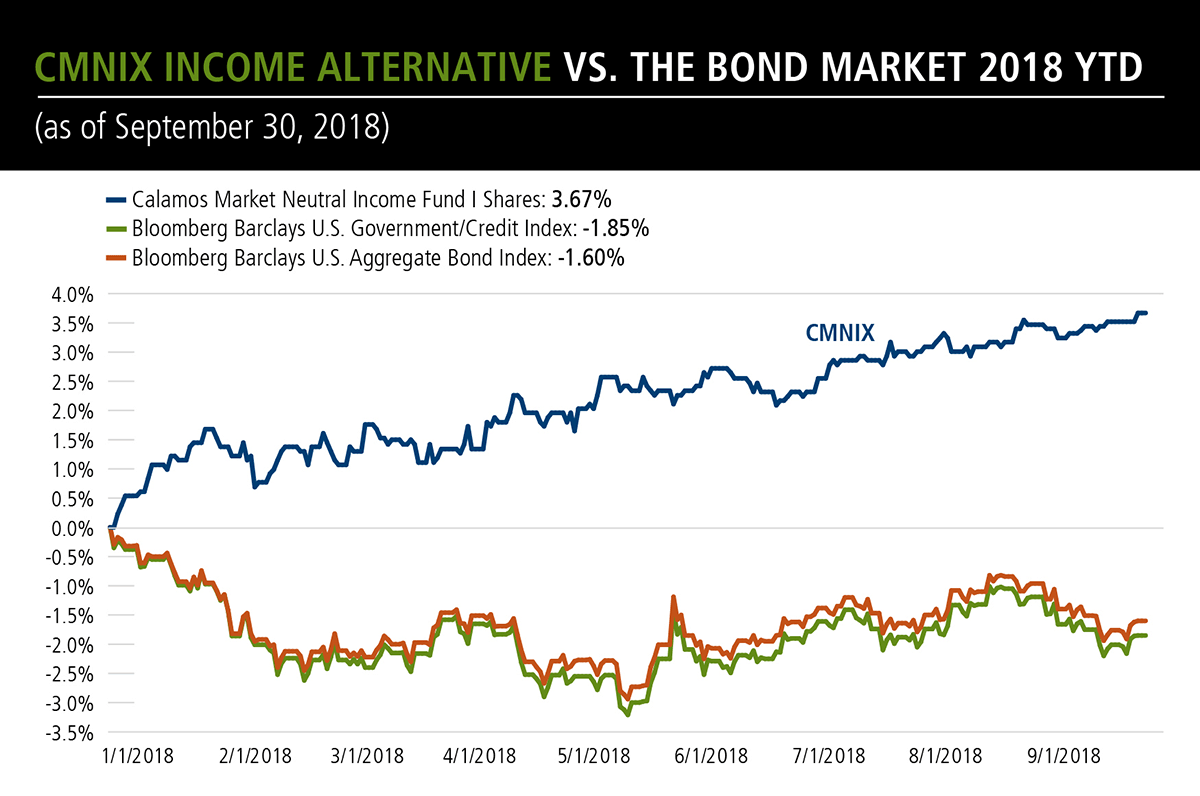

How CMNIX—Our Income Alt—Worked Versus the Bond Market, 2018 YTD

October 12, 2018

First published: June 7, 2018

Our income alternative Calamos Market Neutral Income Fund (CMNIX) deserves a specific shout-out for its performance this year versus the bond market (Bloomberg Barclays U.S. Aggregate Bond Index and Bloomberg Barclays U.S. Government/Credit Index) dealing with its own drama.

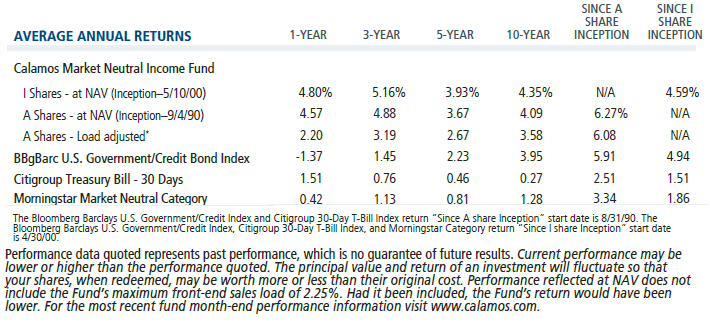

The fund pursues an alternative strategy (including convertible arbitrage and covered call writing) whose goal is to consistently generate income and preserve capital. That’s what it’s done since 1990 over multiple markets representing multiple—and in a few cases unprecedented—challenges.

The first nine months of 2018? Nope, as you can see below, they didn’t faze CMNIX either.

Financial advisors, for more information about CMNIX, please talk to your Calamos Investment Consultant. Call 888-571-2567 or email caminfo@calamos.com. Calamos ranks fifth on the list of alternative fund managers by assets under management in the Morningstar Alternatives Category as of 9/30/18.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Data as of 9/30/18

As of the prospectus dated 3/1/18, the Fund’s gross expense ratio for Class A shares is 1.28%, Class C shares 2.03% and Class I shares is 1.02%.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Alternative investments are not suitable for all investors.

The principal risks of investing in the Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

S&P 500 Index is generally considered representative of the U.S. stock market.

Citigroup 30-Day T-Bill Index is generally considered representative of the performance of short-term money market instruments.

Bloomberg Barclays U.S. Government/Credit Index comprises long-term government and investment grade corporate debt securities and is generally considered representative of the performance of the broad U.S. bond market. Unlike convertible bonds, U.S. Treasury bills are backed by the full faith and credit of the U.S. government and offer a guarantee as to the timely repayment of principal and interest.

Morningstar Market Neutral Category represents funds that attempt to eliminate the risks of the market by holding 50% of assets in long positions in stocks and 50% of assets in short positions.

801161 1018